Draw a Diagram to Illustrate the State of the Economy

10.2 The Furnishings of a Minimum Wage

Learning Objectives

- What happens when a regime imposes a minimum wage?

- If there is inflation under a minimum wage organisation, what happens to the level of employment?

- What are the efficiency costs of a minimum wage?

Adam Smith, the 18th-century economist who founded modern economic science, had a vivid metaphor for the idea that supply would equal demand in a competitive market place: he referred to an "invisible hand" guiding markets to equilibrium. Joan Robinson, a famous economist at Cambridge Academy in the first half of the 20th century, wrote that "the hidden hand volition always do its work but information technology may work by strangulation."Joan Robinson, "The Pure Theory of International Merchandise," in Collected Economic Papers (Oxford: Basil Blackwell, 1966), 189. What she meant by this was at that place is no guarantee that the equilibrium wage in the marketplace would in fact be a living wage.

The Imposition of a Minimum Wage

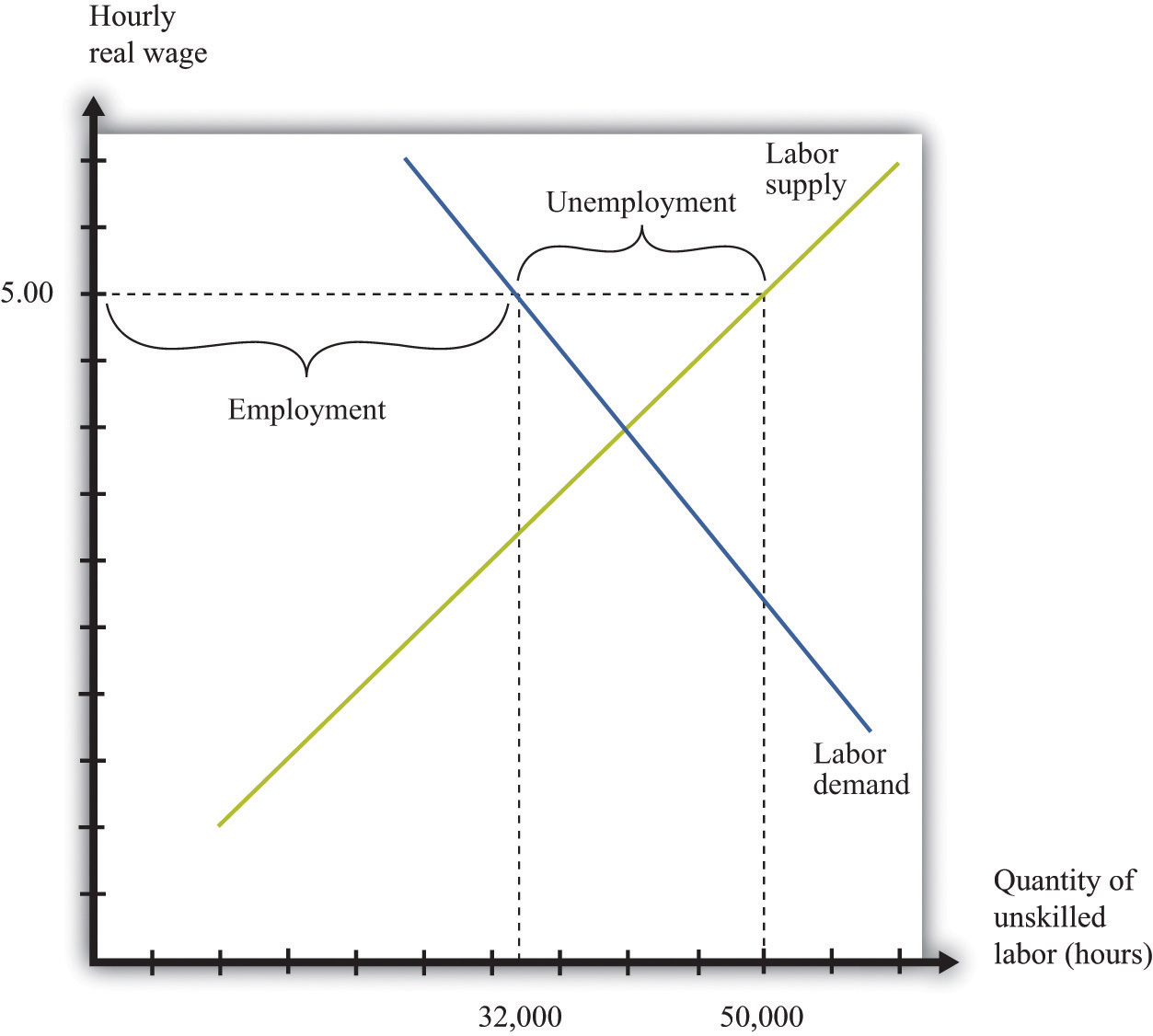

When the government imposes a minimum wage, firms are not permitted to pay less than the corporeality that the government mandates. Suppose we are again in the base of operations yr, so the price level is i. Imagine that the market place equilibrium wage is $4 per hour, but the government now passes legislation stating that all firms must pay at to the lowest degree $5 per hour. At this wage, supply does non equal demand. Figure 10.6 "Labor Market place with a Minimum Wage" illustrates what happens.

Effigy 10.6 Labor Market with a Minimum Wage

With a minimum wage of $5, the supply of labor is 50,000 hours, but firms need only 32,000 hours of labor, so the labor market is not in equilibrium.

Markets are based on voluntary trades. In Figure ten.6 "Labor Market with a Minimum Wage", we see that sellers (the workers who supply labor) would similar to sell 50,000 hours of labor to the market at the set minimum wage—that is, 250 more people would similar to take a 40-hr-a-calendar week task when the wage increases from $four to $five. But firms wish to purchase simply 32,000 hours of labor—firms desire to hire 200 fewer workers (eight,000 fewer hours). In a market place with voluntary trade, no one can force firms to hire workers. As a consequence, the equilibrium quantity of labor traded in the market place will exist determined past how much the firms wish to buy, not how much workers want to sell.

We can now answer our first motivating question of the affiliate: what is the issue of imposing a minimum wage? Two things happen when the government imposes a minimum wage:

- The corporeality of labor hired in the marketplace decreases. In our example, the number of unskilled workers employed decreases from 1,000 to 800. Thus while those who take jobs earn a higher wage, there are now some individuals who no longer have jobs. Employment has decreased.

- At the regime-imposed wage, there are more than people who desire to work than are able to find jobs. Thus the minimum wage has created unemployment. Because 1,250 people would similar jobs at a wage of $five only only 800 jobs are bachelor, 450 people are unemployed; they would like a task at the prevailing wage, but they are unable to find 1.

The number of unemployed workers is 450, even though employment decreased by only 200 workers. The difference comes from the fact that the higher wage also ways that more people desire to work than before. In this case, the higher wage means 250 more than people would like a job.

We have assumed in this word that everyone works for 40 hours, in which case the number of people employed must decrease by 200. Some other possibility is that everyone who wants a job is able to get one, but the number of hours worked past each private decreases. Because in that location are 32,000 hours of work demanded and 1,250 people who want jobs, each worker would work 25.six hours a week. In this situation, we say that there is underemployment rather than unemployment. All the same another possibility is that, after the introduction of the minimum wage, the number of people employed stays the same as before (1,000), merely those individuals are allowed to work only 32 hours per calendar week. In this instance, we accept both underemployment (of the previously employed) and unemployment (of the extra workers who want a chore at the higher wage). In real-life situations, at that place may be both unemployment and underemployment.

Inflation and the Minimum Wage

Although inflation made no difference to our basic assay of the labor market place, it does modify our analysis of the minimum wage. Minimum wages are fixed in nominal terms and do non automatically change when there is inflation. And then if the minimum wage is set at $v and the price level increases from 1 to ane.1, the real minimum wage declines. Looking back at the definition of the existent minimum wage, we find that

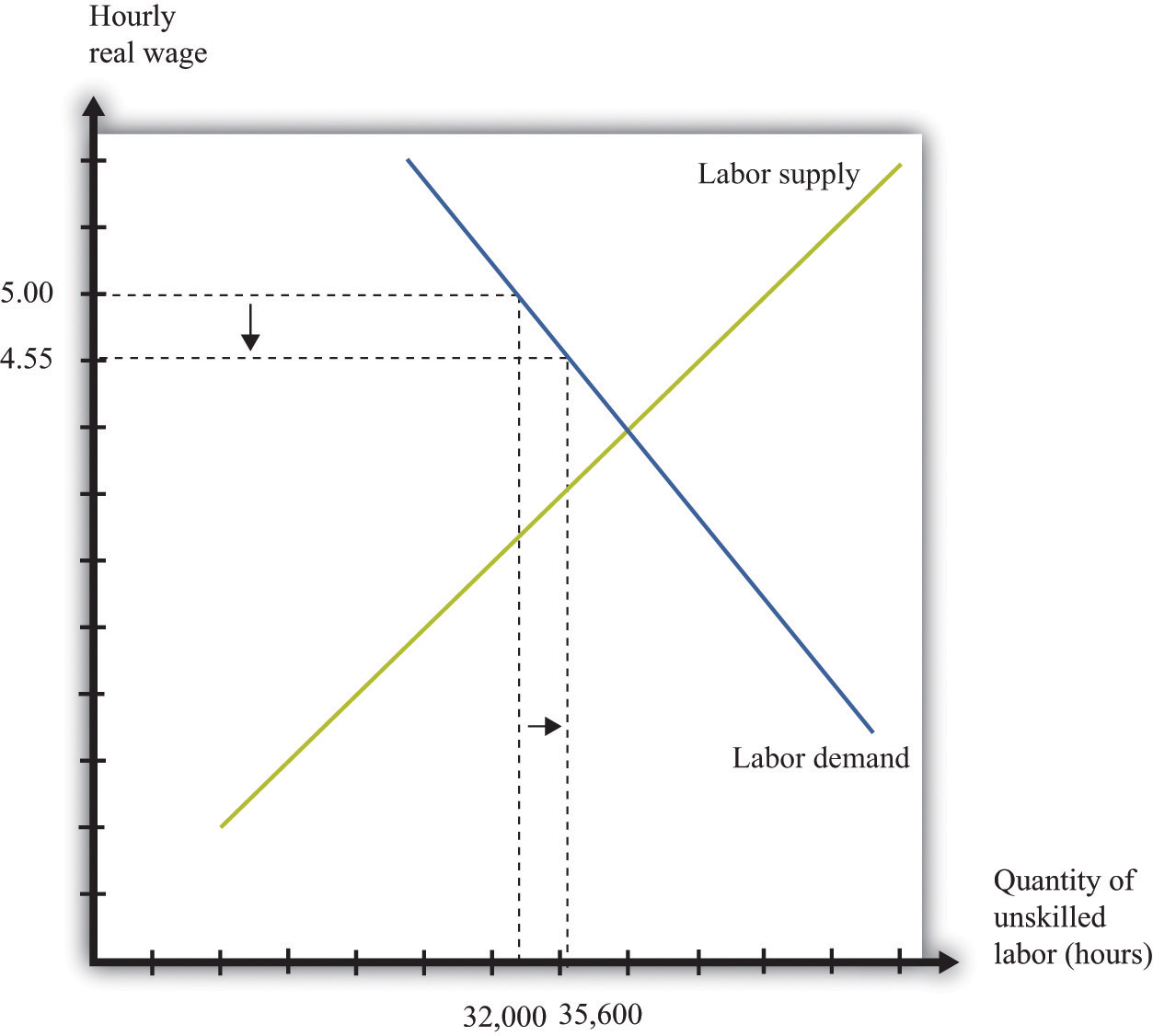

The issue of a reduction in the real minimum wage is shown in Effigy 10.7 "A Reduction in the Real Minimum Wage". At the lower existent wage, firms are willing to rent more workers. Employment increases from 32,000 hours to 35,600 hours: 90 more than people tin can find jobs.

Figure 10.seven A Reduction in the Existent Minimum Wage

A 10-percent increment in the price level leads to a reduction in the real minimum wage to $4.55 and an increment in employment from 32,000 to 35,600.

In Figure 10.vii "A Reduction in the Existent Minimum Wage", the existent minimum wage of $iv.55 is still higher than the equilibrium wage of $four.00. To put the aforementioned point another way, the equilibrium nominal wage has increased to $4.forty, only this is still beneath the nominal minimum wage of $five.00. However, if the price level were to increase by 25 percent or more from the base of operations year, the minimum wage would go completely irrelevant. The minimum wage would be below the market place wage. Economists say that the minimum wage would no longer exist "binding" in this case.

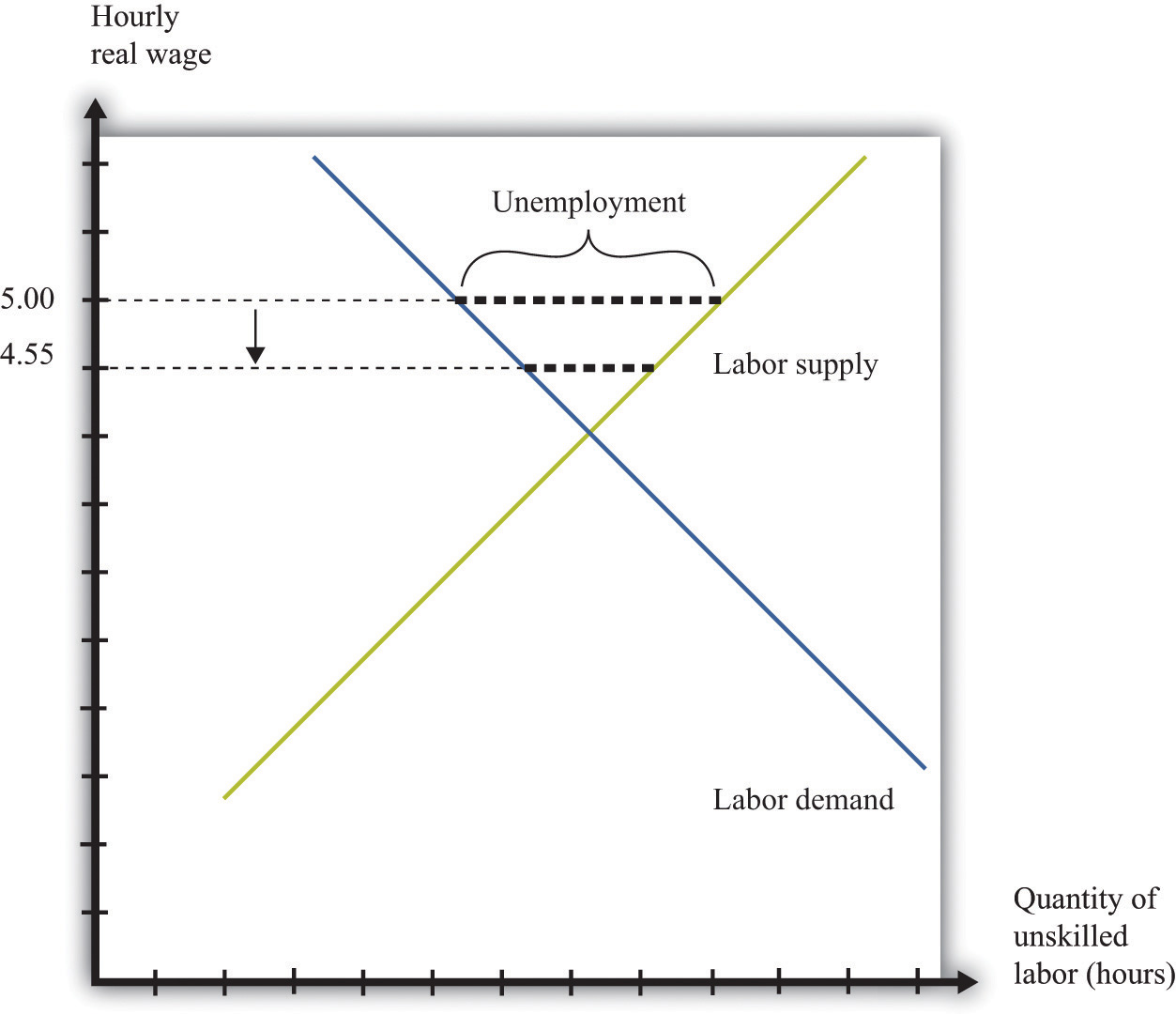

It is exactly this process of increasing prices that lies behind Figure 10.3 "Existent Minimum Wage in the United States". As the price level increases, the minimum wage becomes worth less in existent terms (and has less of an consequence on employment). Somewhen, Congress acts to increment the minimum wage to bring information technology back in line with inflation—although, as Figure 10.3 "Real Minimum Wage in the The states" shows, Congress has allowed the real minimum wage to refuse substantially from its high point in the late 1950s. The reduction in the real minimum wage also leads to a reduction in unemployment, as shown in Figure 10.eight "Effects on Unemployment of a Reduction in the Existent Minimum Wage".

Figure 10.8 Effects on Unemployment of a Reduction in the Real Minimum Wage

The reduction in the real minimum wage to $4.55 leads to a decrease in unemployment.

Efficiency Implications of a Minimum Wage

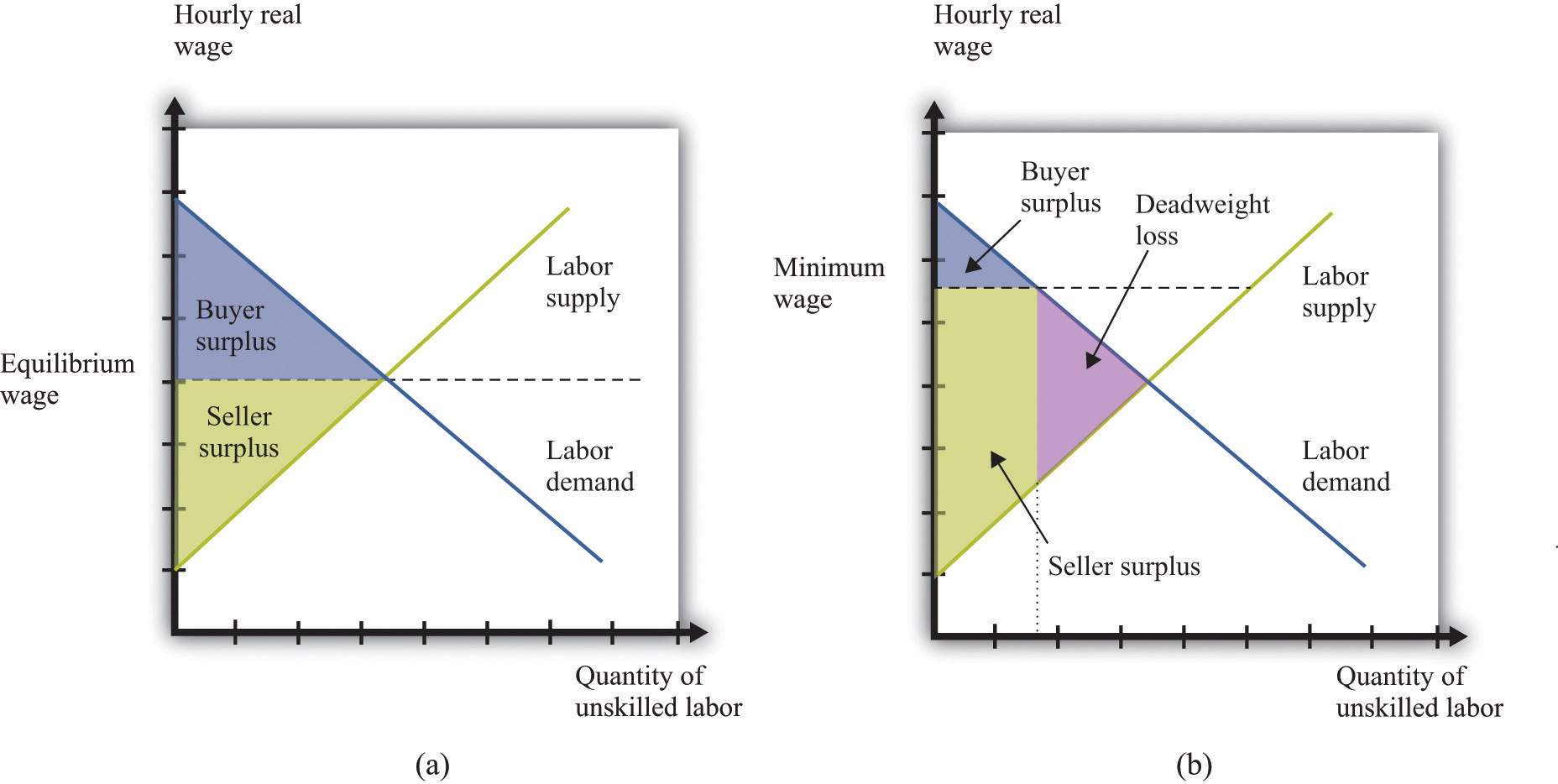

Markets are a machinery that allow individuals to take advantage of gains from trade. Whenever a buyer has a higher valuation than a seller for a skilful or service, they can both benefit from carrying out a trade. This is how economies create value—by finding opportunities for mutually beneficial trades.

The minimum wage interferes with this procedure in the unskilled labor market. It reduces employment, which is the same as saying that fewer transactions accept place. Considering each voluntary transaction by definition generates a surplus, annihilation that reduces the number of transactions causes a loss of surplus. In economists' terminology, the minimum wage leads to a departure from efficiencyThe basis that economists apply for judging the allocation of resources in an economy. . We tin represent that inefficiency graphically. Figure 10.9 "Deadweight Loss from Minimum Wage" shows the upshot of the minimum wage, using the ideas of heir-apparent surplus and seller surplus.

Figure 10.9 Deadweight Loss from Minimum Wage

With no minimum wage (a), all the possible gains from trade in the market are realized, just with a minimum wage (b), some gains from trade are lost because at that place are fewer transactions.

In office (a) of Figure 10.9 "Deadweight Loss from Minimum Wage", we see the market without the minimum wage. In the labor market, it is the firm who is the heir-apparent. The total heir-apparent surplus is the profitRevenues minus costs. that firms obtain past hiring these workers; it is the divergence betwixt the cost of hiring these workers and the revenues that they generate. Graphically, information technology is the area below the labor demand curve and above the market place wage. The total sellersellers' surplus#8217;south surplus is the do good that accrues to workers from selling labor time. Sellers of labor (workers) receive surplus equal to the expanse beneath the market wage and to a higher place the supply curve.

In part (b) of Figure 10.9 "Deadweight Loss from Minimum Wage", we evidence the effect of the minimum wage. As we already know, the higher wage leads to a reduction in employment. Fewer transactions occur, so the total surplus in the market is reduced. Economists phone call the lost surplus the deadweight lossThe economic surplus that disappears as a result of whatever policy that distorts a competitive market and thus causes the total volume of trade to differ from the equilibrium level. from the minimum wage policy.

The nigh obvious cost of the minimum wage is this loss of surplus. Just there may be other hidden costs as well. Whenever people are prevented from carrying out mutually beneficial trades, they take an incentive to try to get around these restrictions. Firms and workers may attempt to "cheat," conducting hidden transactions below the minimum wage. For example, a firm might pay a worker for fewer hours than he or she actually worked. Alternatively, a firm might reduce other benefits of the job. Such cheating not just subverts the minimum wage law but also uses upward resource because the house and the worker must devote effort to devising ways around the constabulary and ensuring that they practice not become caught.

The loss in surplus could too be greater than is shown in Figure 10.9 "Deadweight Loss from Minimum Wage". The figure is fatigued under the presumption that the trades taking place in the labor market are the ones that generate the virtually surplus. Just suppose that the minimum wage is $5.00. It is possible that someone who would exist willing to work for, say, $ii.00 an hour loses her task, whereas someone willing to piece of work for, say, $4.50 is employed.

Recall that if at that place were no restrictions in the labor market, the wage would adjust and so that anyone wanting to work could find a job. This means that both the person willing to piece of work for $2.00 and the person willing to work for $4.l could both find a job every bit long as the wage is in a higher place $4.50. If the equilibrium wage were $4.00, then the person willing to piece of work for just $iv.50 would non be employed. In either case, this is the efficient consequence, consistent with obtaining all the gains from trade.

Primal Takeaways

- When the authorities imposes a minimum wage, the existent wage is adamant past the minimum wage divided by the cost level, not by the interaction betwixt labor supply and demand.

- If there is inflation and a stock-still nominal minimum wage, then the level of employment volition increment and the real minimum wage will decrease.

- The minimum wage creates deadweight loss considering some trades of labor services practice not have identify.

Checking Your Understanding

- Depict a diagram for a labor market where the minimum wage is not binding.

- What happens to the real minimum wage and the level of employment if there is deflation—that is, if the price level decreases?

keislerdortmationat.blogspot.com

Source: https://saylordotorg.github.io/text_microeconomics-theory-through-applications/s14-02-the-effects-of-a-minimum-wage.html

0 Response to "Draw a Diagram to Illustrate the State of the Economy"

Post a Comment